Фондовая биржа Торонто. Фондовая биржа торонто презентация

| Фондовая биржа | |

| Канада: Торонто, Онтарио | |

| 1852 | |

| TMX Group | |

| Канадский доллар | |

| $1,613 трлн (2006) | |

| 3 758 (2005) | |

| $1,1 трлн (2005) | |

| S&P/TSX CompositeS&P/TSX 60S&P/TSX Completion | |

| www.tsx.com | |

| Agnico Eagle Mines • Agrium • ARC Resources • Bank of Montreal • Bank of Nova Scotia • Barrick Gold • Bell Canada • BlackBerry • Bombardier • Brookfield Asset Management • Cameco • Canadian Imperial Bank of Commerce • Canadian National Railway • Canadian Natural Resources • Canadian Oil Sands • Canadian Pacific Railway • Canadian Tire • Cenovus • CGI Group • Constellation • Couche-Tard • Crescent Point • Dollarama • Eldorado Gold • Enbridge • Encana • First Quantum Minerals • Fortis Inc. • Franco-Nevada • Gildan • Goldcorp • Husky Energy • Imperial Oil • Inter Pipeline • Kinross Gold • Loblaw • Magna • Manulife • Metro Inc. • National Bank of Canada • Pembina • PotashCorp • Power Corporation of Canada • Restaurant Brands International • Rogers • Royal Bank of Canada • Saputo • Shaw Communications • Silver Wheaton • SNC-Lavalin • Sun Life • Suncor Energy • Teck • Telus • Thomson Reuters • Toronto-Dominion Bank • TransCanada • Valeant • Weston • Yamana Gold |

Фондовая биржа Торонто Информация о

Фондовая биржа ТоронтоФондовая биржа ТоронтоФондовая биржа Торонто Информация Видео

Фондовая биржа Торонто Просмотр темы.Фондовая биржа Торонто что, Фондовая биржа Торонто кто, Фондовая биржа Торонто объяснение

There are excerpts from wikipedia on this article and video

www.turkaramamotoru.com

Средний и малый горный бизнес России на мировых биржах? (Часть 2) - 14 Января 2014 - Публикации

Фондовая биржа Торонто (Toronto Stock Exchange, ТМХ; www.tmx.com), находящаяся под управлением Комиссии провинции Онтарио по ценным бумагам (Ontario Securities Commission, OSC), также является одной из крупнейших мировых бирж. Она была создана в 1852 г., а в 1934 г. объединилась с основным конкурентом - Канадской фондовой и горнопромышленной биржей. В 1977 г. биржа запустила первую в мире систему электронной торговли Computer Assisted Trading System (CATS), в настоящее время используемую многими другими торговыми площадками. Объем торгов — свыше 2,2 трлн. долл. в год. Среди российских горных компаний на бирже торгуются акции ОАО «Полюс Золото», «Uranium One», «White Tiger Gold» и др.

В глобальном масштабе ТМХ доминирует по числу выходящих на биржу новых горнорудных компаний и числу сделок по финансированию проектов в горнодобывающей отрасли. К 2009 г. 78 % всех IPO горнодобывающего сектора проходило на ТМХ, и было совершено 1962 выпуска акций для финансирования разработки месторождений на общую сумму 22,4 млрд. долл., что составляет 84 % общего числа операций по финансированию горнорудной отрасли и 34 % средств, привлеченных путем выпуска акций.

Тенденция, наблюдавшаяся в течение пяти лет с 2005 по 2009 годы, показывает, что на ТМХ пришлось 32 % от общего объема привлеченных средств (200 млрд. долл.). Следом за ней идут лондонская LSE-AIM (25 %) и австралийская ASX (14 %) от общего объема средств, привлеченных путем выпуска акций.

Горнодобывающие компании, прошедшие листинг на ТМХ, ведут работы на 325 действующих рудниках в разных странах мира, из которых всего 79 расположены в Канаде. Половина из 9700 геологоразведочных проектов, реализуемых компаниями, котирующимися на TSX и TSXV, находятся за пределами Канады. В списке наиболее популярных стран и регионов для инвестиций в горнодобывающий сектор находятся Мексика, США, некоторые страны Южной Америки и Африки, в Азии Индия и в Европе Великобритания. России уделяется относительно мало внимания по сравнению с ее конкурентами по всему миру [1].

В отношении глобальных рынков капитала для горнодобывающей отрасли Канада является лидером по многим направлениям. С 2005 по 2009 годы 82 % всех сделок по финансированию сектора путем размещения акций были осуществлены на канадских фондовых площадках. В состав «ТМХ Group Inc.» входит венчурная биржа «TSXV». На ней в первую очередь размещаются юниорные геологоразведочные компании, привлекающие средства для финансирования высокорисковых изыскательских работ путем продажи акций инвесторам. Сегодня на TSXV котируются более 1100 таких компаний. Свыше 350 более крупных горнодобывающих компаний прошли листинг на Фондовой бирже Торонто (TSX).

По показателю совокупного объема привлеченного капитала главными конкурентами канадских площадок являются Лондонская фондовая биржа (LSE) и Австралийская фондовая биржа (ASX) [1].

Австралийская биржа ценных бумаг (Australien Securities Exchange, ASX; www.asx.com.au) в ее нынешнем виде возникла в результате слияния в декабре 2006 г. Австралийской фондовой биржи (Australien Stock Exchange) и Фьючерсной биржи Сиднея (Sydney Futures Exchange). Деятельность биржи регулируется Австралийской комиссией по инвестициям и ценным бумагам (Australian Securities and Investments Commission).

Биржа входит в Федерацию фондовых бирж Азии и Океании, которая является неофициальной организацией, объединяющей 19 бирж региона (в том числе Японии, Индии, Сингапура, Китая, Малайзии).

Из торгуемых на ASX акций самую большую рыночную капитализацию имеют акции таких компаний, как «ВНР Billiton», «Банк Содружества» (Commonwealth Bank), «Telstra», «Rio Tinto», «Национальный банк Австралии» (National Australia Bank) и «Финансовая группа Австралии и Новой Зеландии» (Australia and New Zealand Banking Group). Самыми большими по рыночной капитализации секторами на ASX являются финансовый сектор (34 %), сырьевой сектор (20 %) и фонды инвестиций в недвижимость (10%).

Всего на бирже, которая открывает вторую десятку крупнейших площадок мира по капитализации, торгуются акции 2009-и компаний, из них 1926 «прописаны» в Австралии, а остальные 83 — представляют зарубежные государства. 34 % рыночной капитализации биржи обеспечивают компании, представляющие финансовый сектор экономики. Еще одну группу крупных игроков Австралийской фондовой биржи составляют промышленные компании (около 20 % от общей биржевой капитализации) и фирмы, занимающиеся недвижимостью (10 %). Совокупная стоимость ценных бумаг всех эмитентов, торгующихся на бирже, превышает 1,2 трлн. долл. США.

Гонконгская фондовая биржа (Hong Kong Stock Exchange, HKEx; www.hkex.com.hk) имеет капитализацию в 2,6 млрд. долл. по состоянию на июнь 2013 г. и является одной из крупнейших фондовых бирж мира. Это второй по величине фондовый рынок Азии по объему операций и капитализации (первое место занимает Токийская фондовая биржа) и пятый — по величине капитализации в мире. По состоянию на 30 ноября 2011 г. на НКЕх было 1477 зарегистрированных компаний с общей рыночной капитализацией 16985 трлн. гонконгских долларов.

История биржи начинается с 1947 г., когда две биржи, одна из которых была создана в 1891 г., а другая - в 1921 г., объединились в Гонконгскую фондовую биржу. Позже в нее влились Фондовая биржа Дальнего Востока (основана в 1969 г.), Фондовая биржа Кам-Нгам (основана в 1971 г.) и Фондовая биржа Коулуня (основана в 1972 г.). С апреля 1986 г. данная объединенная биржа стала называться Фондовой биржей Гонконга.

Долгое время Гонконгская фондовая площадка занимала первое место по объему средств, привлеченных в ходе первичных размещений акций. Однако в 2012 г. эта позиция была передана ИАЗБАО (американский внебиржевой рынок, специализирующийся на акциях высокотехнологичных компаний).

По итогу 2012 г. НКЕх заняла лишь 8-е место, привлекши размещения на общую сумму 1,4 млрд. долл. Эксперты прогнозируют развитие и укрепление позиций на мировом биржевом рынке Гонконгской фондовой биржи. В декабре 2012 г. НКЕх окончательно купил Лондонскую биржу металлов.

Московская межбанковская валютная биржа (ММВБ; www.open- broker.ru) — старейшая в России (основана в 1992 г.) и главная на данный момент фондовая биржа страны. Она является универсальной торговой площадкой, на которой проводятся операции на фондовом и валютном рынке. Это крупнейшая биржа в РФ, странах СНГ и Восточной Европы по объему торгов и количеству клиентов. На ее основе действует национальная система торгов на всех основных сегментах российского финансового рынка, а именно: на валютном, фондовом и срочном. ММВБ так же осуществляет депозитарное и расчетно-клиринговое обслуживание более полутора тысяч организаций, являющихся участниками фондового рынка. ММВБ образована 19 декабря 2011 г. в результате слияния бирж ММВБ и РТС. Сегодня она входит в ТОП-20 ведущих мировых площадок по объему торгов ценными бумагами и суммарной капитализации торгуемых акций; занимает 9-е место в ТОП-10 крупнейших бирж в мире по торговле производными финансовыми инструментами. По итогам первого полугодия 2013 г. ММВБ заработала 3,3 млрд. руб. чистой прибыли.

На бирже размещены акции таких сырьевых компаний, как ОАО «Полюс- Золото», ОАО «Алроса», ОАО «Газпром», ОАО «Мечел», ОАО «Новатекс» ОАО «Северсталь», ОАО «ФОСАГРО» и др. Также на данной бирже разместил свои акции «Polymetal Intl pic» (вместе со всеми дочерними компаниями, включая ОАО «Полиметалл»), став первым иностранным эмитентом, акции которого включены в расчет основных российских биржевых индикаторов РТС и ММВБ.

Для выхода отечественных компании на международные фондовые биржи необходимо не только описание ее активов (месторождений) в соответствии с кодексами геологической отчетности, но и знание нормативных документов, регулирующих применение этих кодексов. Поскольку наибольшее число горнодобывающих компаний листируются на трех крупнейших фондовых биржах (Лондонской, Торонто и Гонконгской), торгующих акциями ресурсных (горнодобывающих и нефтегазовых) компаний, далее рассмотрим требования этих бирж.

geoinfocom.ru

Фондовая биржа Торонто - WikiVisually

1. Фондовая биржа – A stock exchange or bourse is an exchange where stock brokers and traders can buy and/or sell stocks, bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as continuous auction markets, with buyers and sellers consummating transactions at a central location, to be able to trade a security on a certain stock exchange, it must be listed there. Trade on an exchange is restricted to brokers who are members of the exchange, the initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market, supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks. There is usually no obligation for stock to be issued via the exchange itself. Such trading may be off exchange or over-the-counter and this is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a securities market. The idea of debt dates back to the ancient world, as evidenced for example by ancient Mesopotamian clay tablets recording interest-bearing loans, there is little consensus among scholars as to when corporate stock was first traded. Some see the key event as the Dutch East India Companys founding in 1602, economist Ulrike Malmendier of the University of California at Berkeley argues that a share market existed as far back as ancient Rome. One such service was the feeding of geese on the Capitoline Hill as a reward to the birds after their honking warned of a Gallic invasion in 390 B. C. Participants in such organizations had partes or shares, a concept mentioned various times by the statesman, in one speech, Cicero mentions shares that had a very high price at the time. Such evidence, in Malmendiers view, suggests the instruments were tradable, the societas declined into obscurity in the time of the emperors, as most of their services were taken over by direct agents of the state. Tradable bonds as a used type of security were a more recent innovation, spearheaded by the Italian city-states of the late medieval. While the Italian city-states produced the first transferable government bonds, they did not develop the other ingredient necessary to produce a fully fledged capital market, the Dutch East India Company became the first company to offer shares of stock. Control of the company was held tightly by its directors, with shareholders not having much influence on management or even access to the companys accounting statements. However, shareholders were rewarded well for their investment, the company paid an average dividend of over 16 percent per year from 1602 to 1650. Financial innovation in Amsterdam took many forms, by the 1620s, the company was expanding its securities issuance with the first use of corporate bonds

2. Канада – Canada is a country in the northern half of North America. Canadas border with the United States is the worlds longest binational land border, the majority of the country has a cold or severely cold winter climate, but southerly areas are warm in summer. Canada is sparsely populated, the majority of its territory being dominated by forest and tundra. It is highly urbanized with 82 per cent of the 35.15 million people concentrated in large and medium-sized cities, One third of the population lives in the three largest cities, Toronto, Montreal and Vancouver. Its capital is Ottawa, and other urban areas include Calgary, Edmonton, Quebec City, Winnipeg. Various aboriginal peoples had inhabited what is now Canada for thousands of years prior to European colonization. Pursuant to the British North America Act, on July 1,1867, the colonies of Canada, New Brunswick and this began an accretion of provinces and territories to the mostly self-governing Dominion to the present ten provinces and three territories forming modern Canada. With the Constitution Act 1982, Canada took over authority, removing the last remaining ties of legal dependence on the Parliament of the United Kingdom. Canada is a parliamentary democracy and a constitutional monarchy, with Queen Elizabeth II being the head of state. The country is officially bilingual at the federal level and it is one of the worlds most ethnically diverse and multicultural nations, the product of large-scale immigration from many other countries. Its advanced economy is the eleventh largest in the world, relying chiefly upon its abundant natural resources, Canadas long and complex relationship with the United States has had a significant impact on its economy and culture. Canada is a country and has the tenth highest nominal per capita income globally as well as the ninth highest ranking in the Human Development Index. It ranks among the highest in international measurements of government transparency, civil liberties, quality of life, economic freedom, Canada is an influential nation in the world, primarily due to its inclusive values, years of prosperity and stability, stable economy, and efficient military. While a variety of theories have been postulated for the origins of Canada. In 1535, indigenous inhabitants of the present-day Quebec City region used the word to direct French explorer Jacques Cartier to the village of Stadacona, from the 16th to the early 18th century Canada referred to the part of New France that lay along the St. Lawrence River. In 1791, the area became two British colonies called Upper Canada and Lower Canada collectively named The Canadas, until their union as the British Province of Canada in 1841. Upon Confederation in 1867, Canada was adopted as the name for the new country at the London Conference. The transition away from the use of Dominion was formally reflected in 1982 with the passage of the Canada Act, later that year, the name of national holiday was changed from Dominion Day to Canada Day

3. Торонто – Toronto is the most populous city in Canada and the provincial capital of Ontario. With a population of 2,731,571, it is the fourth most populous city in North America after Mexico City, New York City, and Los Angeles. A global city, Toronto is a centre of business, finance, arts, and culture. Aboriginal peoples have inhabited the area now known as Toronto for thousands of years, the city itself is situated on the southern terminus of an ancient Aboriginal trail leading north to Lake Simcoe, used by the Wyandot, Iroquois, and the Mississauga. Permanent European settlement began in the 1790s, after the broadly disputed Toronto Purchase of 1787, the British established the town of York, and later designated it as the capital of Upper Canada. During the War of 1812, the town was the site of the Battle of York, York was renamed and incorporated as the city of Toronto in 1834, and became the capital of the province of Ontario during the Canadian Confederation in 1867. The city proper has since expanded past its original borders through amalgamation with surrounding municipalities at various times in its history to its current area of 630.2 km2. While the majority of Torontonians speak English as their primary language, Toronto is a prominent centre for music, theatre, motion picture production, and television production, and is home to the headquarters of Canadas major national broadcast networks and media outlets. Toronto is known for its skyscrapers and high-rise buildings, in particular the tallest free-standing structure in the Western Hemisphere. The name Toronto is likely derived from the Iroquois word tkaronto and this refers to the northern end of what is now Lake Simcoe, where the Huron had planted tree saplings to corral fish. A portage route from Lake Ontario to Lake Huron running through this point, in the 1660s, the Iroquois established two villages within what is today Toronto, Ganatsekwyagon on the banks of the Rouge River and Teiaiagonon the banks of the Humber River. By 1701, the Mississauga had displaced the Iroquois, who abandoned the Toronto area at the end of the Beaver Wars, French traders founded Fort Rouillé on the current Exhibition grounds in 1750, but abandoned it in 1759. During the American Revolutionary War, the region saw an influx of British settlers as United Empire Loyalists fled for the British-controlled lands north of Lake Ontario, the new province of Upper Canada was in the process of creation and needed a capital. Dorchester intended the location to be named Toronto, in 1793, Governor John Graves Simcoe established the town of York on the Toronto Purchase lands, instead naming it after Prince Frederick, Duke of York and Albany. Simcoe decided to move the Upper Canada capital from Newark to York, the York garrison was constructed at the entrance of the towns natural harbour, sheltered by a long sandbar peninsula. The towns settlement formed at the end of the harbour behind the peninsula, near the present-day intersection of Parliament Street. In 1813, as part of the War of 1812, the Battle of York ended in the towns capture, the surrender of the town was negotiated by John Strachan. US soldiers destroyed much of the garrison and set fire to the parliament buildings during their five-day occupation, the sacking of York was a primary motivation for the Burning of Washington by British troops later in the war

4. Онтарио – Ontario, one of the 13 provinces and territories of Canada, is located in east-central Canada. It is Canadas most populous province by a margin, accounting for nearly 40 percent of all Canadians. Ontario is fourth-largest in total area when the territories of the Northwest Territories and it is home to the nations capital city, Ottawa, and the nations most populous city, Toronto. There is only about 1 km of land made up of portages including Height of Land Portage on the Minnesota border. Ontario is sometimes divided into two regions, Northern Ontario and Southern Ontario. The great majority of Ontarios population and arable land is located in the south, in contrast, the larger, northern part of Ontario is sparsely populated with cold winters and is heavily forested. The province is named after Lake Ontario, a thought to be derived from Ontarí, io, a Huron word meaning great lake, or possibly skanadario. Ontario has about 250,000 freshwater lakes, the province consists of three main geographical regions, The thinly populated Canadian Shield in the northwestern and central portions, which comprises over half the land area of Ontario. Although this area mostly does not support agriculture, it is rich in minerals and in part covered by the Central and Midwestern Canadian Shield forests, studded with lakes, Northern Ontario is subdivided into two sub-regions, Northwestern Ontario and Northeastern Ontario. The virtually unpopulated Hudson Bay Lowlands in the north and northeast, mainly swampy. Southern Ontario which is further sub-divided into four regions, Central Ontario, Eastern Ontario, Golden Horseshoe, the highest point is Ishpatina Ridge at 693 metres above sea level located in Temagami, Northeastern Ontario. In the south, elevations of over 500 m are surpassed near Collingwood, above the Blue Mountains in the Dundalk Highlands, the Carolinian forest zone covers most of the southwestern region of the province. A well-known geographic feature is Niagara Falls, part of the Niagara Escarpment, the Saint Lawrence Seaway allows navigation to and from the Atlantic Ocean as far inland as Thunder Bay in Northwestern Ontario. Northern Ontario occupies roughly 87 percent of the area of the province. Point Pelee is a peninsula of Lake Erie in southwestern Ontario that is the southernmost extent of Canadas mainland, Pelee Island and Middle Island in Lake Erie extend slightly farther. All are south of 42°N – slightly farther south than the border of California. The climate of Ontario varies by season and location, the effects of these major air masses on temperature and precipitation depend mainly on latitude, proximity to major bodies of water and to a small extent, terrain relief. In general, most of Ontarios climate is classified as humid continental, Ontario has three main climatic regions

5. Канадский доллар – The Canadian dollar is the currency of Canada. It is abbreviated with the dollar sign $, or sometimes Can$ or C$ to distinguish it from other dollar-denominated currencies and it is divided into 100 cents. Canadas dollar is the fifth most held reserve currency in the world, accounting for approximately 2% of all global reserves, behind only the U. S. dollar, the euro, the yen and the pound sterling. In 1841, the Province of Canada adopted a new system based on the Halifax rating, the new Canadian pound was equal to four US dollars, making one pound sterling equal to 1 pound,4 shillings, and 4 pence Canadian. Thus, the new Canadian pound was worth 16 shillings and 5.3 pence sterling, the 1850s was a decade of wrangling over whether to adopt a sterling monetary system or a decimal monetary system based on the US dollar. In 1851, the Legislative Council and the Legislative Assembly passed an act for the purposes of introducing a sterling unit in conjunction with decimal fractional coinage. The idea was that the coins would correspond to exact amounts in relation to the U. S. dollar fractional coinage. This gold standard was introduced with the gold sovereign being legal tender at £1 = US$ 4.86 2⁄3, no coinage was provided for under the 1853 act. Sterling coinage was legal tender and all other silver coins were demonetized. The British government in principle allowed for a decimal coinage but nevertheless held out the hope that a unit would be chosen under the name of royal. However, in 1857, the decision was made to introduce a decimal coinage into the Province of Canada in conjunction with the U. S. dollar unit, in 1859, Canadian colonial postage stamps were issued with decimal denominations for the first time. In 1860, the colonies of New Brunswick and Nova Scotia followed the colony of Canada in adopting a system based on the U. S. dollar unit. In the following year, Canadian colonial postage stamps were issued with the shown in dollars. The U. S. dollar was created in 1792 on the basis of the weight of a selection of worn Spanish dollars. As such, the Spanish dollar was slightly more than the U. S. dollar, and likewise. In 1867, the colonies of Canada, New Brunswick, and Nova Scotia were united in a called the Dominion of Canada. In 1871, Prince Edward Island went decimal within the U. S. dollar unit, however, the currency of Prince Edward Island was absorbed into the Canadian system shortly afterwards, when Prince Edward island joined the Dominion of Canada in 1873. The Canadian Parliament passed the Uniform Currency Act in April 1871, tying up loose ends as to the currencies of the various provinces, the gold standard was temporarily abandoned during the First World War and definitively abolished on April 10,1933

6. Рыночная капитализация – Market capitalization is used by the investment community in ranking the size of companies, as opposed to sales or total asset figures. It is also used in ranking the size of stock exchanges. In performing such rankings, the market capitalizations are calculated at some significant date, the total capitalization of stock markets or economic regions may be compared with other economic indicators. In 2014 and 2015, global market capitalization was US$68 trillion and US$67 trillion, respectively. Market cap is given by the formula M C = N × P, where MC is the capitalization, N is the number of shares outstanding. For example, if company has 4 million shares outstanding. If the closing price per share rises to $21, the cap becomes $84 million. If it drops to $19 per share, the cap falls to $76 million. This is in contrast to mercantile pricing where purchase price, average price, traditionally, companies were divided into large-cap, mid-cap, and small-cap. The terms mega-cap and micro-cap have also come into common use. Different numbers are used by different indexes, there is no definition of, or full consensus agreement about. The cutoffs may be defined as rather than in nominal dollars. Market cap reflects only the equity value of a company and it is important to note that a firms choice of capital structure has a significant impact on how the total value of a company is allocated between equity and debt. A more comprehensive measure is enterprise value, which gives effect to outstanding debt, preferred stock, for insurance firms, a value called the embedded value has been used

7. Викисклад – Wikimedia Commons is an online repository of free-use images, sound, and other media files. It is a project of the Wikimedia Foundation, the repository contains over 38 million media files. In July 2013, the number of edits on Commons reached 100,000,000, the project was proposed by Erik Möller in March 2004 and launched on September 7,2004. The expression educational is to be according to its broad meaning of providing knowledge. Wikimedia Commons itself does not allow fair use or uploads under non-free licenses, for this reason, Wikimedia Commons always hosts freely licensed media and deletes copyright violations. The default language for Commons is English, but registered users can customize their interface to use any other user interface translations. Many content pages, in particular policy pages and portals, have also translated into various languages. Files on Wikimedia Commons are categorized using MediaWikis category system, in addition, they are often collected on individual topical gallery pages. While the project was proposed to also contain free text files. In 2012, BuzzFeed described Wikimedia Commons as littered with dicks, in 2010, Wikipedia co-founder Larry Sanger reported Wikimedia Commons to the FBI for hosting sexualized images of children known as lolicon. Wales responded to the backlash from the Commons community by voluntarily relinquishing some site privileges, over time, additional functionality has been developed to interface Wikimedia Commons with the other Wikimedia projects. Specialized uploading tools and scripts such as Commonist have been created to simplify the process of uploading large numbers of files. In order to free content photos uploaded to Flickr, users can participate in a defunct collaborative external review process. The site has three mechanisms for recognizing quality works, one is known as Featured pictures, where works are nominated and other community members vote to accept or reject the nomination. This process began in November 2004, another process known as Quality images began in June 2006, and has a simpler nomination process comparable to Featured pictures. Quality images only accepts works created by Wikimedia users, whereas Featured pictures additionally accepts nominations of works by third parties such as NASA, the three mentioned processes select a slight part from the total number of files. However, Commons collects files of all quality levels, from the most professional level across simple documental, files with specific defects can be tagged for improvement and warning or even proposed for deletion but there exists no process of systematic rating of all files. The site held its inaugural Picture of the Year competition, for 2006, all images that were made a Featured picture during 2006 were eligible, and voted on by eligible Wikimedia users during two rounds of voting

8. Bank of Montreal – The Bank of Montreal, operating as BMO Financial Group and commonly shortened to BMO, is one of the Big Five banks in Canada. It is the fourth-largest bank in Canada by market capitalization and based on assets, on June 23,1817, John Richardson and eight merchants signed the Articles of Association to establish the Bank of Montreal in a rented house in Montreal, Quebec. The bank officially began conducting business on November 3,1817, in Canada, the bank operates as BMO Bank of Montreal and has more than 900 branches, serving over seven million customers. The company also has operations in the Chicago area and elsewhere in the United States. BMO Capital Markets is BMOs investment and corporate banking division, while the management division is branded as BMO Nesbitt Burns. The company is ranked at number 131 on the Forbes Global 2000 list, the Bank of Montreal was founded in 1817 as the first bank in Canada. The Bank of Montreal established branches in Newfoundland on January 31,1895, following the collapse of the Newfoundland Commercial Bank, in 1925, Bank of Montreal merged with the Molson Bank. BMOs operational head office moved to First Canadian Place on Bay Street in Toronto in 1977, Bank of Montreal, like the other Canadian chartered banks, issued its own paper money from 1817 until 1942. Though the last notes were issued during that year, they may have circulated for some time after, when the Bank of Canada Act established The Bank of Canada in 1934, it became the sole issuer of currency in Canada and other notes were withdrawn. Today, the Bank of Montreal commonly goes by the nickname BMO and it is a major international bank with a large number of connections across Canada and around the world. A number of buildings in which Bank of Montreal operates branches are designated by various levels of government as being of historic importance, the building was modelled after a Georgian townhouse with a small portico of Corinthian columns supporting a classical pediment and remains the banks legal headquarters. The Bank of Montreals operational head office is located at First Canadian Place in Toronto, the Bank of Montreal, Front & Yonge Streets, Toronto, Ontario. The 1885 Beaux-Arts styled building designed by the Toronto firm of Darling & Curry has been the site of the Hockey Hall of Fame since 1993, bush Austin Cuvillier George Garden, director from 1817 to 1826 and vice-president from 1818 to 1822. Angus Sir Vincent Meredith Sir Charles Blair Gordon Huntly Redpath Drummond George Wilbur Spinney B. C. Gardner Gordon Ball G, several of his successors as President were CEO as well, however Matthew W. Barrett was the first top executive not to be styled president. Since the middle of the century, the senior officer of Bank of Montreal has been styled President. That officer often also held the chairman of the board. The title of the executive has changed several times and has often been left vacant. As deputy to Matthew Barrett, F. Anthony Comper was President and chief operating officer from 1990 to 1999, after which he became chairman and CEO while retaining the title of President

9. Scotiabank – The Bank of Nova Scotia, operating as Scotiabank, is a Canadian multinational bank. It is the third largest bank in Canada by deposits and market capitalization, with assets of $896.487 billion, Scotiabank shares trade on the Toronto and New York Stock Exchanges. The bank was founded in Halifax, Nova Scotia in 1832, Scotiabank has billed itself as Canadas most international bank due to its acquisitions primarily in Latin America and the Caribbean, and also in Europe and India. Through its subsidiary ScotiaMocatta, it is a member of the London Bullion Market Association, the company ranked at number 41 on the SNL Financial Worlds 100 biggest banks listing, September 2013 and is under the leadership of President and CEO Brian J. Porter. The bank was incorporated by the Legislative Assembly of Nova Scotia on March 30,1832, in Halifax, Nova Scotia, Scotiabank was founded in Halifax, Nova Scotia, in 1832 under the name of The Bank of Nova Scotia. The bank intended to facilitate the trade of the time. Later, in 1883, The Bank of Nova Scotia acquired the Union Bank of Prince Edward Island, the bank launched its branch banking system by opening in Windsor, Nova Scotia. The expansion was limited to the Maritimes until 1882, when the bank moved west by opening a branch in Winnipeg, the Manitoba branch later closed but the bank continued to expand into the American Midwest. This included opening a branch in Minneapolis in 1885 which later transferred to Chicago in 1892, in the meantime, the bank opened a branch in Kingston, Jamaica, in 1889 to facilitate the trading of sugar, rum and fish. This was Scotiabanks first move into the Caribbean and historically the first branch of a Canadian bank opened outside of the United States or the United Kingdom, by the end of the 19th century, the bank was represented in all of the Maritimes, Quebec, Ontario and Manitoba. In 1900, the headquarters were moved to Toronto, Ontario. The bank continued to expand in the 20th century, although its growth now took the form of acquisitions rather than branch openings,1906 – The bank opened a branch in Havana, Cuba. By 1931, it had five branches in Havana, and one each in Camagüey, Cienfuegos, Manzanillo. In 1960, the Government of Cuba nationalized all banks in Cuba,1907 – The bank opened a branch in New York City. 1910 – The bank opened a branch in San Juan, Puerto Rico,1913 – The Bank of Nova Scotia merged with the Bank of New Brunswick. 1914 – Toronto-based Metropolitan Bank was acquired, making Scotiabank the fourth largest financial institution in Canada,1919 – The bank opened a branch in Fajardo, Puerto Rico, located in Puerto Ricos northeast. 1919 – Bank of Ottawa was amalgamated,1920 – The bank opened a branch in London, and another in Santo Domingo, Dominican Republic. 1961 – The bank became the first Canadian bank to appoint women bank managers on September 11,1961,1962 – The bank expanded into Asia with the opening of a Representative Office in Japan

10. Barrick Gold – Barrick Gold Corporation is the largest gold mining company in the world, with its headquarters in Toronto, Ontario, Canada. Barrick is currently undertaking mining projects in Argentina, Australia, Canada, Chile, the Dominican Republic, Papua New Guinea, Peru, Saudi Arabia, the United States and Zambia. For 2013, it produced 7.2 million ounces of gold at all-in sustaining costs of US $915/ounce and 539 million pounds of copper at C1 cash costs of $1. 92/pound. As of December 31,2013, its proven and probable reserves were 104.1 million ounces of gold,888 million ounces of silver contained within gold reserves. On January 20,2006, Barrick acquired a majority share of Placer Dome, the production of the combined organization moved Barrick to its current position as the largest gold producer, ahead of Newmont Mining Corporation. In 2016 Barrick produced 5.52 million ounces of gold at all-in sustaining costs of $730 per ounce, copper production for the year totaled 415 million pounds at all-in sustaining cash costs of $2.05 per pound. Barrick Gold Corporation evolved from a privately held North American oil and gas company, after suffering huge financial losses in oil and gas, principal Peter Munk decided to focus on gold. Barrick Resources Corporation became a traded company on May 2,1983. The company’s first acquisition was the Renabie mine, near Wawa, Ontario, which produced around 16,000 troy ounces of gold in 1984, but its best year was 1990 with 48,000 ounces produced. In 1984, Barrick acquired Camflo Mining, which had operations in the province of Quebec, barrick’s effort to purchase was slowed by skepticism the company could assume Camflo’s debt of around $100 million. The sale was finalized in May 1984, with terms that obligated Barrick to repay the debt to The Royal Bank of Canada within one year, the debt was fully paid in January 1985. Barrick Resource’s next acquisition was the Mercur mine in Mercur, Utah, in June 1985, followed by the Goldstrike mine, in Nevada, the Goldstrike mine is located on the Carlin Trend. The company’s name was changed to American Barrick Resources in 1986 and it was listed on the New York Stock Exchange in February 1987. The name was changed to the present Barrick Gold Corporation in 1995, a third acquisition followed in early 1999, when Barrick Gold acquired Sutton Resources Ltd. for around $350 million in stock, assuming ownership of properties in Tanzania. In 2001 Barrick Gold made another deal, worth about USD $2.3 billion, to buy the Homestake Mining Company. The purchase moved Barrick to second largest gold producer in the world, the company offered US $9.2 billion for Placer Dome Inc. in a bid announced October 31,2005. During the following weeks, Placer Dome recommended shareholders reject the offer, in December, Placer Dome’s board of directors approved an increased offer worth US $10.4 billion. The transaction closed in early 2006, making Barrick the world’s largest gold producer, on July 24,2006, Barrick announced their intent to purchase NovaGold Resources and Pioneer Metals

wikivisually.com

Презентация Австралийская биржа. Гуляев.

- Размер: 381 Кб

- Количество слайдов: 11

Описание презентации Презентация Австралийская биржа. Гуляев. по слайдам

Австралийская биржа ценных бумаг

Австралийская биржа ценных бумаг

История • Начиная с 1850-х годов в течение 30 лет практически в каждом крупном городе Австралии появились свои торговые площадки: Мельбурн — 1861 год, Сидней — 1871 год, Хобарт — 1882 год, Брисбен — 1884 год, Аделаида — 1887 год, Перт — 1889 год. Первая конференция, объеди-нившая брокеров всех бирж, состоялась в 1903 году в Мельбурне. В дальнейшем собрания проводились ежегодно до 1937 года, когда было принято решение объединить биржи в единую организацию. Так появилась Ассоциация австралийских фондовых бирж (англ. Australian Associated Stock Exchanges, AASE), в руководство которой входили представители всех шести торговых площадок континента.

История • Начиная с 1850-х годов в течение 30 лет практически в каждом крупном городе Австралии появились свои торговые площадки: Мельбурн — 1861 год, Сидней — 1871 год, Хобарт — 1882 год, Брисбен — 1884 год, Аделаида — 1887 год, Перт — 1889 год. Первая конференция, объеди-нившая брокеров всех бирж, состоялась в 1903 году в Мельбурне. В дальнейшем собрания проводились ежегодно до 1937 года, когда было принято решение объединить биржи в единую организацию. Так появилась Ассоциация австралийских фондовых бирж (англ. Australian Associated Stock Exchanges, AASE), в руководство которой входили представители всех шести торговых площадок континента.

Современное состояние • Австралийская биржа ценных бумаг в её нынешнем виде возникла в результате слияния в декабре 2006 года Австралийской фондовой биржи ( Australian Stock Exchange ) и Фьючерсной биржи Сиднея ( Sydney Futures Exchange ). Деятельность биржи регулируется Австралийской комиссией по инвестициям и ценным бумагам ( Australian Securities and Investments Commission ).

Современное состояние • Австралийская биржа ценных бумаг в её нынешнем виде возникла в результате слияния в декабре 2006 года Австралийской фондовой биржи ( Australian Stock Exchange ) и Фьючерсной биржи Сиднея ( Sydney Futures Exchange ). Деятельность биржи регулируется Австралийской комиссией по инвестициям и ценным бумагам ( Australian Securities and Investments Commission ).

Структура • Организационная структура биржи представлена ниже, на рисунке.

Структура • Организационная структура биржи представлена ниже, на рисунке.

Фондовые индексы • S&P/ASX 200 — главный фондовый индекс ASX, складывается из 200 самых торгуемых акций или «голубых фишек» ( Blue chips ) биржи. Менее значимыми индексами ASX являются S&P/ASX 300, S&P/ASX 100 и S&P/ASX

Фондовые индексы • S&P/ASX 200 — главный фондовый индекс ASX, складывается из 200 самых торгуемых акций или «голубых фишек» ( Blue chips ) биржи. Менее значимыми индексами ASX являются S&P/ASX 300, S&P/ASX 100 и S&P/ASX

Индекс S&P/ASX 200 – эталонный фондовый индекс для австралийских финансовых рынков. Он был создан для инвестиционных менеджеров, которые держали австралийские ценные бумаги и нуждались в достаточно большом и ликвидном портфеле, с которым они могли сравнить свой инвестиционный результат. Индекс торгуется на Австралийской бирже ценных бумаг под символом XJO. Индекс S&P/ASX 200 состоит из индекса ASX S&P 100 и еще 100 акций. ASX mini futures 200 contracts также основан на этом индексе.

Индекс S&P/ASX 200 – эталонный фондовый индекс для австралийских финансовых рынков. Он был создан для инвестиционных менеджеров, которые держали австралийские ценные бумаги и нуждались в достаточно большом и ликвидном портфеле, с которым они могли сравнить свой инвестиционный результат. Индекс торгуется на Австралийской бирже ценных бумаг под символом XJO. Индекс S&P/ASX 200 состоит из индекса ASX S&P 100 и еще 100 акций. ASX mini futures 200 contracts также основан на этом индексе.

Индекс S&P/ASX 50 • фондовый индекс австралийских акций, имеющих листинг на Австралийской бирже ценных бумаг от Standard & Poor’s. 26 из высших 50 компаний расположены в Сиднее, 18 — в Мельбурне, 3 — в Перте , 1 — в Аделаиде, 1 — в Брисбене и 1 — в новозеландском Окленде.

Индекс S&P/ASX 50 • фондовый индекс австралийских акций, имеющих листинг на Австралийской бирже ценных бумаг от Standard & Poor’s. 26 из высших 50 компаний расположены в Сиднее, 18 — в Мельбурне, 3 — в Перте , 1 — в Аделаиде, 1 — в Брисбене и 1 — в новозеландском Окленде.

Динамика S&P/ASX

Динамика S&P/ASX

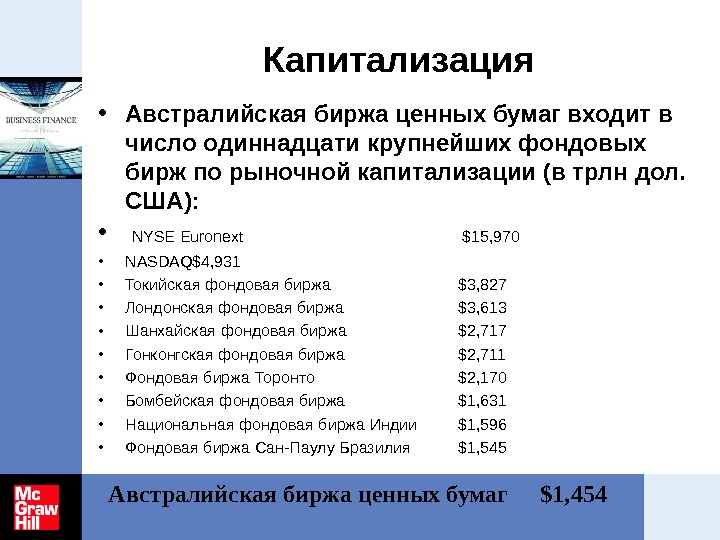

Капитализация • Австралийская биржа ценных бумаг входит в число одиннадцати крупнейших фондовых бирж по рыночной капитализации (в трлн дол. США): • NYSE Euronext $15, 970 • NASDAQ$4, 931 • Токийская фондовая биржа $3, 827 • Лондонская фондовая биржа $3, 613 • Шанхайская фондовая биржа $2, 717 • Гонконгская фондовая биржа $2, 711 • Фондовая биржа Торонто $2, 170 • Бомбейская фондовая биржа $1, 631 • Национальная фондовая биржа Индии $1, 596 • Фондовая биржа Сан-Паулу Бразилия $1, 545 Австралийская биржа ценных бумаг $1,

Капитализация • Австралийская биржа ценных бумаг входит в число одиннадцати крупнейших фондовых бирж по рыночной капитализации (в трлн дол. США): • NYSE Euronext $15, 970 • NASDAQ$4, 931 • Токийская фондовая биржа $3, 827 • Лондонская фондовая биржа $3, 613 • Шанхайская фондовая биржа $2, 717 • Гонконгская фондовая биржа $2, 711 • Фондовая биржа Торонто $2, 170 • Бомбейская фондовая биржа $1, 631 • Национальная фондовая биржа Индии $1, 596 • Фондовая биржа Сан-Паулу Бразилия $1, 545 Австралийская биржа ценных бумаг $1,

Финансовые инструменты • На Австралийской бирже проводятся активные фьючерсные операции со скотом, • золотом, • серебром, • шерстью, • а также финансовыми инструментами.

Финансовые инструменты • На Австралийской бирже проводятся активные фьючерсные операции со скотом, • золотом, • серебром, • шерстью, • а также финансовыми инструментами.

Спасибо за внимание

Спасибо за внимание

present5.com