Будапештская фондовая биржа. Будапештская фондовая биржа

Будапештская фондовая биржа - Википедия

| Будапештская фондовая биржаBudapesti Értéktőzsde | |

|

| |

| Будапешт, Венгрия | |

| 1864 (как Венгерская фондовая биржа — предшественница современной биржи) | |

| Венгерский форинт | |

| www.bse.hu | |

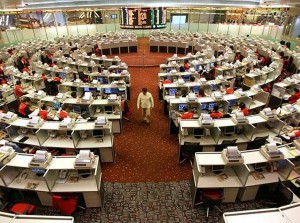

Будапештская фондовая биржа (венг. Budapesti Értéktőzsde) — фондовая биржа в Венгрии. Располагается в Будапеште.

Содержание

- 1 События

- 2 Источники

- 3 См. также

- 4 Ссылки

События[ | ]

С лета 1932 года по осень 1933 года биржа была закрыта по причине экономического кризиса.

Источники[ | ]

См. также[ | ]

- Компании, имеющие листинг акций на Будапештской бирже

Ссылки[ | ]

- Официальный сайт биржи

| ANY • • • • • FHB Bank • Gedeon Richter • • Magyar Telekom • MOL • OTP Bank • • Rába • Zwack Unicum |

encyclopaedia.bid

Будапештская фондовая биржа - WikiVisually

1. Будапешт – Budapest is the capital and most populous city of Hungary, one of the largest cities in the European Union and sometimes described as the primate city of Hungary. It has an area of 525 square kilometres and a population of about 1.8 million within the limits in 2016. Budapest became a single city occupying both banks of the Danube river with the unification of Buda and Óbuda on the west bank, the history of Budapest began with Aquincum, originally a Celtic settlement that became the Roman capital of Lower Pannonia. Hungarians arrived in the territory in the 9th century and their first settlement was pillaged by the Mongols in 1241–1242. The re-established town became one of the centres of Renaissance humanist culture by the 15th century, following the Battle of Mohács and nearly 150 years of Ottoman rule, the region entered a new age of prosperity, and Budapest became a global city after its unification in 1873. It also became the co-capital of the Austro-Hungarian Empire, a power that dissolved in 1918. Budapest was the point of the Hungarian Revolution of 1848, the Hungarian Republic of Councils in 1919, the Battle of Budapest in 1945. Budapest is an Alpha- global city, with strengths in arts, commerce, design, education, entertainment, fashion, finance, healthcare, media, services, research, and tourism. Its business district hosts the Budapest Stock Exchange and the headquarters of the largest national and international banks and it is the highest ranked Central and Eastern European city on Innovation Cities Top 100 index. Budapest attracts 4.4 million international tourists per year, making it the 25th most popular city in the world, further famous landmarks include Andrássy Avenue, St. It has around 80 geothermal springs, the worlds largest thermal water system, second largest synagogue. Budapest is home to the headquarters of the European Institute of Innovation and Technology, the European Police College, over 40 colleges and universities are located in Budapest, including the Eötvös Loránd University, Central European University and Budapest University of Technology and Economics. Budapest is the combination of the city names Buda and Pest, One of the first documented occurrences of the combined name Buda-Pest was in 1831 in the book Világ, written by Count István Széchenyi. The origins of the names Buda and Pest are obscure, according to chronicles from the Middle Ages, the name Buda comes from the name of its founder, Bleda, brother of the Hunnic ruler Attila. The theory that Buda was named after a person is also supported by modern scholars, an alternative explanation suggests that Buda derives from the Slavic word вода, voda, a translation of the Latin name Aquincum, which was the main Roman settlement in the region. There are also theories about the origin of the name Pest. One of the states that the word Pest comes from the Roman times. According to another theory, Pest originates from the Slavic word for cave, or oven, the first settlement on the territory of Budapest was built by Celts before 1 AD

2. Венгрия – Hungary is a unitary parliamentary republic in Central Europe. With about 10 million inhabitants, Hungary is a member state of the European Union. The official language is Hungarian, which is the most widely spoken language in Europe. Hungarys capital and largest metropolis is Budapest, a significant economic hub, major urban areas include Debrecen, Szeged, Miskolc, Pécs and Győr. His great-grandson Stephen I ascended to the throne in 1000, converting the country to a Christian kingdom, by the 12th century, Hungary became a middle power within the Western world, reaching a golden age by the 15th century. Hungarys current borders were established in 1920 by the Treaty of Trianon after World War I, when the country lost 71% of its territory, 58% of its population, following the interwar period, Hungary joined the Axis Powers in World War II, suffering significant damage and casualties. Hungary became a state of the Soviet Union, which contributed to the establishment of a four-decade-long communist dictatorship. On 23 October 1989, Hungary became again a democratic parliamentary republic, in the 21st century, Hungary is a middle power and has the worlds 57th largest economy by nominal GDP, as well as the 58th largest by PPP, out of 188 countries measured by the IMF. As a substantial actor in several industrial and technological sectors, it is both the worlds 36th largest exporter and importer of goods, Hungary is a high-income economy with a very high standard of living. It keeps up a security and universal health care system. Hungary joined the European Union in 2004 and part of the Schengen Area since 2007, Hungary is a member of the United Nations, NATO, WTO, World Bank, the AIIB, the Council of Europe and Visegrád Group. Well known for its cultural history, Hungary has been contributed significantly to arts, music, literature, sports and science. Hungary is the 11th most popular country as a tourist destination in Europe and it is home to the largest thermal water cave system, the second largest thermal lake in the world, the largest lake in Central Europe, and the largest natural grasslands in Europe. The H in the name of Hungary is most likely due to historical associations with the Huns. The rest of the word comes from the Latinized form of Medieval Greek Oungroi, according to an explanation the Greek name was borrowed from Proto-Slavic Ǫgǔri, in turn borrowed from Oghur-Turkic Onogur. Onogur was the name for the tribes who later joined the Bulgar tribal confederacy that ruled the eastern parts of Hungary after the Avars. The Hungarians likely belonged to the Onogur tribal alliance and it is possible they became its ethnic majority. The Hungarian endonym is Magyarország, composed of magyar and ország, the word magyar is taken from the name of one of the seven major semi-nomadic Hungarian tribes, magyeri

3. Фондовая биржа – A stock exchange or bourse is an exchange where stock brokers and traders can buy and/or sell stocks, bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as continuous auction markets, with buyers and sellers consummating transactions at a central location, to be able to trade a security on a certain stock exchange, it must be listed there. Trade on an exchange is restricted to brokers who are members of the exchange, the initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market, supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks. There is usually no obligation for stock to be issued via the exchange itself. Such trading may be off exchange or over-the-counter and this is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a securities market. The idea of debt dates back to the ancient world, as evidenced for example by ancient Mesopotamian clay tablets recording interest-bearing loans, there is little consensus among scholars as to when corporate stock was first traded. Some see the key event as the Dutch East India Companys founding in 1602, economist Ulrike Malmendier of the University of California at Berkeley argues that a share market existed as far back as ancient Rome. One such service was the feeding of geese on the Capitoline Hill as a reward to the birds after their honking warned of a Gallic invasion in 390 B. C. Participants in such organizations had partes or shares, a concept mentioned various times by the statesman, in one speech, Cicero mentions shares that had a very high price at the time. Such evidence, in Malmendiers view, suggests the instruments were tradable, the societas declined into obscurity in the time of the emperors, as most of their services were taken over by direct agents of the state. Tradable bonds as a used type of security were a more recent innovation, spearheaded by the Italian city-states of the late medieval. While the Italian city-states produced the first transferable government bonds, they did not develop the other ingredient necessary to produce a fully fledged capital market, the Dutch East India Company became the first company to offer shares of stock. Control of the company was held tightly by its directors, with shareholders not having much influence on management or even access to the companys accounting statements. However, shareholders were rewarded well for their investment, the company paid an average dividend of over 16 percent per year from 1602 to 1650. Financial innovation in Amsterdam took many forms, by the 1620s, the company was expanding its securities issuance with the first use of corporate bonds

4. Государственная типография Венгрии – ANY Security Printing Company or ANY Biztonsági Nyomda Nyrt. is one of the largest security printing companies in Hungary and the CEE region. Previously, the company produced traditional printing products, today its activities are focused on document security products and solutions, plastic card production and personalization, electronic document management and bulk transactional printing. The company’s shares have been listed on the Budapest Stock Exchange since December 2005, the printing house began operation in 1851 and became the largest institution in a town which already had highly developed printing houses. In 1868 the company moved its operation nearer to the government district of Buda Castle in order to supply the Hungarian government with state administration forms. In 1869 the government decided on the merger of the two printing houses, as it was necessary to solve the production of fee stamps which were very important for the Finance Ministry. Due to the merger and development, the conditions were realized for fast and reliable production of fee stamps and this extended to other state administration and treasury forms. The new institution was officially named Hungarian Royal State Printing House, after the 1901 reorganization, the company’s name was changed to State Printing House. The Hungarian government founded the Hungarian Banknote Printing House in 1922 which started domestic banknote printing in August 1923 in the buildings of the State Printing House, during World War II, the printing house served as a war factory producing food and fuel notes. After the war, the documents of the post and the railway were printed again as well as forms, bonds. For the 1945 election, State Printing House printed the election forms, the company has been producing lottery forms and tickets since 1947. Besides production of lottery forms and tickets, the production of election forms every four years also became part of the production portfolio. Due to the investment in 1957, the capacity was expanded and the quality improved, in the 1960 the company began to print export stamps as well. For the general public, stamp production became the most well-known activity of State Printing House over the decades, previously, these fees could be paid for only by parallel-published stamps which were produced in Vienna. The fee stamps were produced in Hungary from 1869, in the State Printing House managed by the independent Finance Ministry, the provision of the 1867 Compromise concerning postal services came into effect on 1 May. All of the post offices on the territory of Hungary came under the competence of the Hungarian Post Directorate, so a natural claim came forward that independently published Hungarian stamps should be put on the mails of the Hungarian Post. As this claim was approved by the government, the first Hungarian newspaper stamp was published on 20 June 1868. However, this was printed in the Viennese printing house and a German inscription could be read on the watermark, the inscription on the stamp itself was Hungarian, and the stamp design was decorated by the Hungarian coat of arms and crown. The first postal stamp produced in Hungary was issued in 1871 after the production line of State Printing House was developed

5. FHB Mortgage Bank – FHB Mortgage Bank is Hungarys largest mortgage re-financer. Formerly state-owned, it was floated on the market in 2003. As of 17 August 2011, FHB Mortgage Bank Co, plc. has market capitalization of US$232.4 million

6. Gedeon Richter – Gedeon Richter Plc. is a Hungarian multinational pharmaceutical and biotechnology company headquartered in Budapest, Hungary. It is one of the largest companies of the industry in the Central, the company sells products for gynecology, the central nervous system, and cardiology areas among other therapeutic areas. The company was established in Budapest by Gedeon Richter, a pharmacist, the establishment of his firm marked the beginning of the development of the Hungarian pharmaceutical industry. Gedeon Richter Plc. has a listing on the Budapest Stock Exchange and is a constituent of the BUX Index. It had a capitalisation of approximately $4 billion as of November 2015. It has secondary listings on Euronext, initially, small-scale pharmaceutical production took place in the Arany Sas Pharmacy, which still operates today. Independent pharmaceutical research and production activities were launched in Hungary in those days, initially, the laboratory that operated on the premises of the pharmacy processed extracts from organs of animals and produced organotherapeutic drugs. The plant was built in 1907 in the Kőbánya suburb of Budapest, the company became a highly recognized manufacturer of lecithin products, antiseptic and febrifuge products, as well as painkillers. In 1934 Constant Janssen, of the future Janssen Pharmaceuticals, acquired the rights for Gedeon Richters products. The corporation has two plants today, the headquarters in Budapest, and a subsidiary in Dorog since 1967, in October 2010, Gedeon Richter Plc. acquired 100% of a private Swiss drug company, Preglem, for CHF445 million. The company has joint ventures in India—with Themis Medicare, and in Germany, Economy of Budapest Economy of Hungary Science and technology in Hungary Official website Company headquarters location in Budapest, Hungary, 47°28′6. 90″N 19°8′55. 17″E

7. Magyar Telekom – Magyar Telekom Nyrt. is the largest Hungarian telecommunications company. The former monopolist is now a subsidiary of Deutsche Telekom, until 6 May 2005, it was known as MATÁV. The company was formed under the name of Magyar Távközlési Vállalat in December 1989, on 31 December 1991, the company was re-structured as a Public Limited Company, as Magyar Távközlési Rt. and the company remained in 100% state ownership until the end of 1993. On 1 July 1993, the Telecommunications Act came into effect, a consortium was formed by Deutsche Telekom and Ameritech International, which was named MagyarCom, and bought into the company a share of 30. 1% for a price of 875 million USD. Matáv, out of the tender with the aim of acquiring and purchasing shares of Matávs national telephone concession. Matávs service area Hungary about 70% of the territory and 72% of the population covered 36 primary areas covered, during the privatization process MagyarCom in the Matáv it acquired a majority stake. Under the contract signed on 22 December st 1995, Magyar Telekom Group covers three business areas, wireline services, mobile communications, services provided to business customers. In the frame of the project is elaborated such a pilot ENUM system, a web-based GUI is provided both for the administration and the managing of user profiles. In the field of IP telephony services and applications they have implemented the integration of hardware-based telephones. They have elaborated such a QoS measuring method, with the help of which the quality of the VoIP service can be tested and measured on a scale. A special case of mobility is the so-called nomadic mobility, when the user, an average laptop user can hardly concentrate on his work, while he is on the way. He needs network connection only when he stopped and can pull out his laptop from his bag, in the course of our developments Magyar Telekom have been analyzing the possibilities of providing VoIP connection for such wandering subscribers. Magyar Telekom has already announced its new WiMax technology based service, in the interest of it, they have created a test environment on which the system integration and functional tests can be carried out prior to general rollout. The traditional twisted copper pair continues to be a determinant element of access networks, systems of the past have been improved in efficiency through numerous innovations and the appearing newer and newer technologies offer further possibilities for the providers. In the frame of this research we have been analyzing the possibilities of new generation xDSL technologies, achievable bandwidth, reachable distance, and the triple-play features of equipment are in the focus of the tests. Moreover, we carry out analyses and measurements to identify the conditions of system integration of DSLAM-s with Ethernet uplink. At the same time, an exact and accurate calculation method giving the optimum for the location based on the parameters of the network. The R&D theme has the purpose to explore the mentioned interrelations and through practical measurements to verify, official website Today Matáv has officially changed its name to Magyar Telekom

8. MOL – MOL Group, commonly known as MOL, is a Hungarian multinational oil and gas company headquartered in Budapest, Hungary. MOL is the second most valuable company in Central and Eastern Europe, MOL placed 402 on the Fortune Global 500 list of the worlds largest companies in 2013. MOLs revenue was equal to one fifth of Hungarys GDP at the time. As of November 2015 the largest shareholder is Hungarian state with 24. 74% ahead of ČEZ Group with 7. 35%, OmanOil Budapest with 7. 00%, more than 50% of shares are free floated. It has minor renewable energy activities in the form of biofuels and it has operations in over 40 countries worldwide, it has nearly 2,000 service stations in 11 countries under seven brands, and it is a market leader in Hungary, Slovakia, Croatia. MOLs downstream operations manufacture and sell products such as fuels, lubricants, additives, the companys most significant areas of operations are Central and Eastern Europe, Southern Europe, North Sea, Middle East and Russia. MOL has a listing on the Budapest Stock Exchange and is a constituent of the BUX Index. It had a market more than $7 billion at the close of trading on 3 November 2015. It has secondary listings on Euronext and Warsaw Stock Exchange, MOL Nyrt. was established on 1 October 1991 through the merger of 9 companies as a legal successor of former members of the National Oil and Gas Trust which was established in 1957. By 1995, the integration of companies was completed. MOL went for a strategy in order to respond to international market challenges and also, it pioneered in the regional consolidation of the oil. In 2003, MOL purchased a 25% stake in Croatias national oil company INA, in 2006, INA and MOL launched a joint exploration project in the Slatina – Zaláta area designed to secure new volumes of natural gas. MOL further increased its stake in TVK to 86. 56% in 2006, between 2003 and 2005, MOL completed the acquisition of Shell Romania. In 2004, MOL entered the Austrian market by purchasing a storage facility in Korneuburg. In August 2007, MOL purchased Italiana Energia e Servizi S. p. A. owner of the Mantua refinery, in November 2007, MOL reported a new regional initiative to create a joint regional gas pipeline system called New European Transmission System. On 20 December 2007, MOL announced a cooperation with Czech power utility CEZ. The joint venture with CEZ focuses on gas-fired power generation and related gas infrastructure in Central and Southeastern Europe, first launching two 800 MW power plants in Hungary and Slovakia. After selling 7% of its shares to CEZ within the scopes of a strategic partnership, in June 2007, Austrian energy company OMV made an unsolicited bid to take over MOL, which has been rejected by the Hungarian company

9. OTP Group – OTP Bank Group is one of the largest independent financial services providers in Central and Eastern Europe with full range of banking services for private individuals and corporate clients. OTP Group comprise large subsidiaries, granting services in the field of insurance, real estate, factoring, leasing and asset management, investment and pension funds. The bank is serving clients in 9 countries, namely Hungary, Slovakia, Bulgaria, Serbia, Romania, Croatia, Ukraine, Montenegro and Russia. Nowadays OTP Groups more than 36,000 employees are serving 13 million clients in over 1,500 branches, OTP is still the largest commercial bank in Hungary with over 25% market share. OTP Group started its activity in 1949 when OTP Bank was founded as a state savings, OTP stands for Országos Takarék Pénztár which indicates the origin purpose of establishment of the bank. The bank went public in 1995, and the share of the state in the bank decreased to one preferential gold share. Currently most of the shares are owned by private and institutional investors. OTP has a free float shareholder structure, the free float ratio reaches the 68. The rest is held by one of the Forbes billionaire Megdet Rahimkulov in 8, 88%, Hungarian MOL Group in 8, 57%, French Groupama in 8, 30% and American Lazard in 5, 64%. The predecessor of OTP Bank, called the National Savings Bank was established in 1949 as a nationwide, state-owned, banking entity providing retail deposits, in the ensuing years, its activities and the scope of its authority gradually widened. First, it was authorised to enter into real estate transactions, since 1989, the bank has operated as a multi-functional commercial bank. In 1990, the National Savings Bank became a company with a share capital of HUF23 billion. Its name was changed to the National Savings and Commercial Bank, subsequently, non-banking activities were separated from the bank, along with their supporting organisational units. The state lottery was reorganised into a separate state-owned company and OTP Real Estate was established as a subsidiary of the bank, OTP Banks privatisation began in 1995. As a result of 3 public offers along with the introduction of the shares into the Budapest Stock Exchange the states ownership in the bank decreased to a single voting preference share. Currently the bank is characterized by dispersed ownership of mostly private, after the realisation of its own privatisation process, OTP Bank started its international expansion targeting countries in CEE region. OTP Bank has completed several acquisitions in the past years, besides Hungary, OTP Group currently operates in 8 countries of the region via its subsidiaries, in Bulgaria, in Croatia, in Romania, in Serbia, in Slovakia, in Ukraine, in Montenegro and in Russia. 2008 was milestone in OTP Bank history since it was the first time to one of its subsidiaries

wikivisually.com

Будапештская фондовая биржа — Википедия (с комментариями)

Материал из Википедии — свободной энциклопедии

| Будапештская фондовая биржа Budapesti Értéktőzsde | |

|

| |

| Будапешт, Венгрия | |

| 1864 (как Венгерская фондовая биржа — предшественница современной биржи) | |

| Венгерский форинт | |

| BUX BUMIX CETOP 20 | |

| [www.bse.hu/ www.bse.hu] | |

Будапештская фондовая биржа (венг. Budapesti Értéktőzsde) — фондовая биржа в Венгрии. Располагается в Будапеште.

События

С лета 1932 года по осень 1933 года биржа была закрыта по причине экономического кризиса.

Источники

См. также

Напишите отзыв о статье "Будапештская фондовая биржа"

Ссылки

- [www.bse.hu/ Официальный сайт биржи]

Координаты: 47°30′38″ с. ш. 19°04′18″ в. д. / 47.510446° с. ш. 19.071643° в. д. / 47.510446; 19.071643 (G) [www.openstreetmap.org/?mlat=47.510446&mlon=19.071643&zoom=14 (O)] (Я)

Отрывок, характеризующий Будапештская фондовая биржа

Войну такого рода назвали партизанскою и полагали, что, назвав ее так, объяснили ее значение. Между тем такого рода война не только не подходит ни под какие правила, но прямо противоположна известному и признанному за непогрешимое тактическому правилу. Правило это говорит, что атакующий должен сосредоточивать свои войска с тем, чтобы в момент боя быть сильнее противника. Партизанская война (всегда успешная, как показывает история) прямо противуположна этому правилу. Противоречие это происходит оттого, что военная наука принимает силу войск тождественною с их числительностию. Военная наука говорит, что чем больше войска, тем больше силы. Les gros bataillons ont toujours raison. [Право всегда на стороне больших армий.] Говоря это, военная наука подобна той механике, которая, основываясь на рассмотрении сил только по отношению к их массам, сказала бы, что силы равны или не равны между собою, потому что равны или не равны их массы. Сила (количество движения) есть произведение из массы на скорость. В военном деле сила войска есть также произведение из массы на что то такое, на какое то неизвестное х. Военная наука, видя в истории бесчисленное количество примеров того, что масса войск не совпадает с силой, что малые отряды побеждают большие, смутно признает существование этого неизвестного множителя и старается отыскать его то в геометрическом построении, то в вооружении, то – самое обыкновенное – в гениальности полководцев. Но подстановление всех этих значений множителя не доставляет результатов, согласных с историческими фактами.wiki-org.ru

Будапештская фондовая биржа Вики

| Будапештская фондовая биржа Budapesti Értéktőzsde | |

| |

| Будапешт, Венгрия | |

| 1864 (как Венгерская фондовая биржа — предшественница современной биржи) | |

| Венгерский форинт | |

| BUX BUMIX CETOP 20 | |

| www.bse.hu | |

Будапештская фондовая биржа (венг. Budapesti Értéktőzsde) — фондовая биржа в Венгрии. Располагается в Будапеште.

Содержание

- 1 События

- 2 Источники

- 3 См. также

- 4 Ссылки

События[ | код]

С лета 1932 года по осень 1933 года биржа была закрыта по причине экономического кризиса.

Источники[ | код]

См. также[ | код]

- Компании, имеющие листинг акций на Будапештской бирже

Ссылки[ | код]

- Официальный сайт биржи

|

ru.wikibedia.ru

Budapest Stock Exchange, BSE | Будапештская фондовая биржа

Предшественник современной Будапештской фондовой биржи (Budapest Stock Exchange, BSE) - Венгерская фондовая биржа (Hungarian Stock Exchange, HSE) начала свою деятельность 18 января 1864 году в Пеште. Хотя изначально HSE создавалась как фондовая биржа, через четыре года был открыт зал для торговли зерном, который стал главной товарной площадкой страны. Таким образом образовалась Будапештская фондовая и товарная биржа (Budapest Stock and Commodity Exchange (BSCE)). Под этим именем торговая площадка проработала 80 лет и стала одной из ведущих фондовых бирж в Европе. Начиная с 1889 года цены на акции компаний, котирующихся на Будапештской фондовой бирже, также стали публиковаться в Вене, Франкфурте, Лондоне и Париже, что свидетельствует о международном значении BSE. C 1890 года венгерские государственные облигации регулярно торгуются на фондовых биржах Лондона, Парижа, Амстердама и Берлина.На рубеже XIX века на бирже обращалось уже 310 ценных бумаг, к началу первой мировой войны эта цифра возросла до 500. Годовой оборот 1913 года составлял один миллион акций. Параллельно развивалась и товарная биржа, объем торгов к началу Первой мировой войны вырос почти в 3 раза по сравнению с 1875 годом, и достиг одного с половинной миллиона тонн. В результате BSCE стремительно завоёвывала позицию ведущей торговой площадки зерном в Европе. После Второй мировой войны в 1948 году в результате национализации большинства частных венгерских фирм, правительство официально распустило Будапештскую фондовую и товарную биржу, и активы Биржи перешли в государственную собственность.Современная Budapest Stock Exchange открыла свои двери 21 июня 1990 года с 41 членом-учредителей, в состав которых вошли банки, брокерские и страховые компании, а в том числе и национальный банк Венгрии National Bank of Hungary (NBH). В первый день торговля велась только акциями одной компании - IBUSZ.В ноябре 1198 года была запущена новая торговая система MultiMarket Trading System (MMTS), и к сентябрю 1999 года все торговые операции перевели с физического исполнения на электронное.В январе 2010 года Будапештская биржа становится членом холдинга CEESEG AG (Фондовой биржи Центральной и Восточной Европы), которому принадлежит контрольный пакет акций BSE 50,45%. 6 декабря 2013 года был осуществлен переход на новую торговую систему Xetra, которая объединила трейдеров и инвесторов 18 европейских стран, открывая для венгерских клиентов доступ к тысячи новых инструментов и предоставляя новые возможности для расширения рынка.

Предшественник современной Будапештской фондовой биржи (Budapest Stock Exchange, BSE) - Венгерская фондовая биржа (Hungarian Stock Exchange, HSE) начала свою деятельность 18 января 1864 году в Пеште. Хотя изначально HSE создавалась как фондовая биржа, через четыре года был открыт зал для торговли зерном, который стал главной товарной площадкой страны. Таким образом образовалась Будапештская фондовая и товарная биржа (Budapest Stock and Commodity Exchange (BSCE)). Под этим именем торговая площадка проработала 80 лет и стала одной из ведущих фондовых бирж в Европе. Начиная с 1889 года цены на акции компаний, котирующихся на Будапештской фондовой бирже, также стали публиковаться в Вене, Франкфурте, Лондоне и Париже, что свидетельствует о международном значении BSE. C 1890 года венгерские государственные облигации регулярно торгуются на фондовых биржах Лондона, Парижа, Амстердама и Берлина.На рубеже XIX века на бирже обращалось уже 310 ценных бумаг, к началу первой мировой войны эта цифра возросла до 500. Годовой оборот 1913 года составлял один миллион акций. Параллельно развивалась и товарная биржа, объем торгов к началу Первой мировой войны вырос почти в 3 раза по сравнению с 1875 годом, и достиг одного с половинной миллиона тонн. В результате BSCE стремительно завоёвывала позицию ведущей торговой площадки зерном в Европе. После Второй мировой войны в 1948 году в результате национализации большинства частных венгерских фирм, правительство официально распустило Будапештскую фондовую и товарную биржу, и активы Биржи перешли в государственную собственность.Современная Budapest Stock Exchange открыла свои двери 21 июня 1990 года с 41 членом-учредителей, в состав которых вошли банки, брокерские и страховые компании, а в том числе и национальный банк Венгрии National Bank of Hungary (NBH). В первый день торговля велась только акциями одной компании - IBUSZ.В ноябре 1198 года была запущена новая торговая система MultiMarket Trading System (MMTS), и к сентябрю 1999 года все торговые операции перевели с физического исполнения на электронное.В январе 2010 года Будапештская биржа становится членом холдинга CEESEG AG (Фондовой биржи Центральной и Восточной Европы), которому принадлежит контрольный пакет акций BSE 50,45%. 6 декабря 2013 года был осуществлен переход на новую торговую систему Xetra, которая объединила трейдеров и инвесторов 18 европейских стран, открывая для венгерских клиентов доступ к тысячи новых инструментов и предоставляя новые возможности для расширения рынка.

Основным индексом Будапештской фондовой биржи является BUX – индекс голубых фишек. Начал публиковаться 6 января 1995 года. Рассчитывается в режиме реального времени и показывает среднее изменение цен акций с максимальной рыночной ценой.

finwiz.ru

База расчёта индекса Будапештской фондовой биржи

База расчёта индекса Будапештской фондовой биржи